Welcome to the "Unofficial" Simonton Texas Media and Information Website.

The City of Simonton City Council Special Meeting Held 04-23-2024

Featured Real Estate Listing

Important Links

City

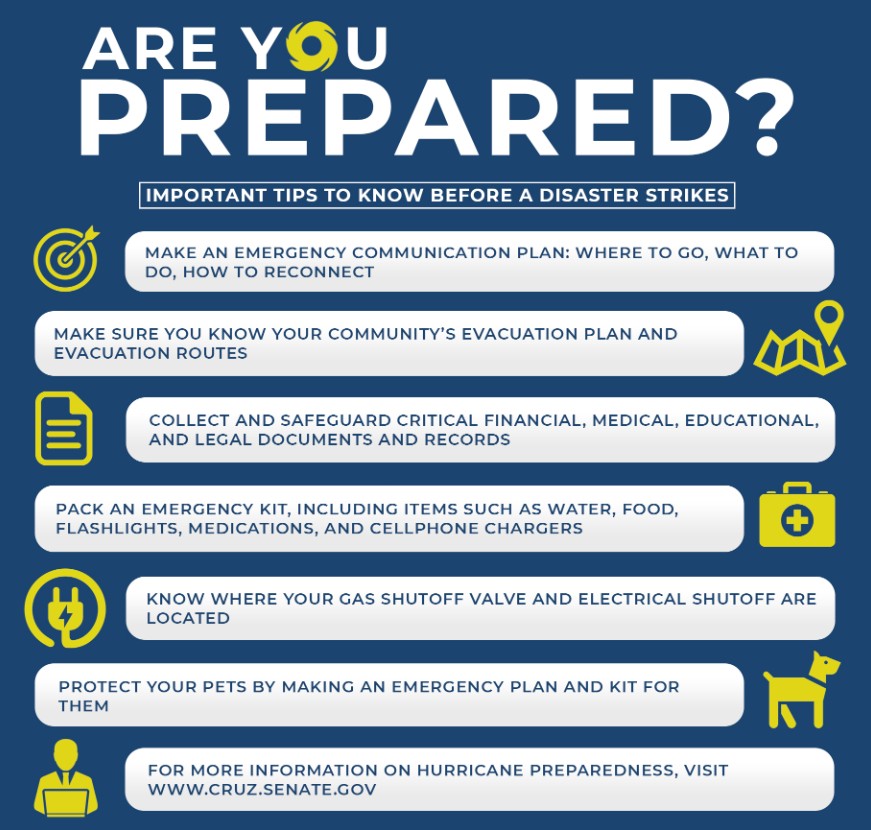

From the State of Texas.

An Overview of Economic Development, how the EDC’s are created, their functions, who can be on them and most importantly, whose money is it?

https://comptroller.texas.gov/economy/local/type-ab/establish.php

EDC “A”

The “City of Simonton Development Corporation”, also known as “EDC A”, was incorporated on February 11, 2009 with the mission of “…the furtherance of aiding, promoting, and furthing the economic development of the City of Simonton, Texas”.

Want to see the founding documents for EDC “A”?

EDC “A” – Articles of Incorporation, EDC “A”

————————

EDC “B”

The “Simonton Development Corporation”, also known as “EDC B”, was incorporated on February 11, 2009. According to the founding documents, “The corporation is organized for the the public purpose of furtherance of aiding, promoting, and furthing the economic development of the City pursuant to the provisions of the Act”.

Want to see the founding documents for EDC “B”?

EDC B – Articles of Incorporation

————————

Who is Joe Esch?

His company is Esch Development Solutions, LLC. He is a resident of Weston, Lakes. He has an extensive history in economic development.

His proposal includes “Fee Schedule” and “Estimated Fee for Services”

His hourly fee is $250 per hour + $125 per hour for travel, plus mileage at the IRS rate of 58.5 cents per mile.

He proposed, and presumably was paid $2000 as a program assessment fee.

He proposed, and presumably was paid $1000 + $2500 for “Board Education”.

He proposed to be paid $1000 per meeting – he anticipates 4 meetings. Not sure if that is 4 meetings for each of the two Economic Development Corporate Boards or not. The By-Laws for each of the two Economic Development Corporations require each of the 2 boards to meet 3 times per year – something that hasn’t happened consistently in a few years under the current administration. You can do the math on your own, but Joe could be leaving money on the table.

Below is a screen capture from the city website that shows the current city council membership. Your council members’ specific email address are not made available by the city to the general public. If you want to contact them, the city asks that you do so through their online form.

Election Information

The City Council of the City of Simonton meets in regular session on the 3rd Tuesday of each month. On occasion, the City Council meets on the 1st Tuesday of the month or in “Special Sessions” as may be required to transact city business as well as for workshops, certain hearings, emergencies, etc.

When I hear of a meeting being posted, I will certainly post it here as well.

Also, I plan to video each meeting I attend. Meeting videos will be posted as soon as possible afterwards – right here on SimontonTexas.com.

If you want to follow the City Meeting Announcements on your own, please visit the City’s website.